Learn indispensable advanced accrual-based accounting techniques that bookkeepers rely on to increase the accuracy of a company's financial reports.

What You’ll Learn

- The difference between Cash vs. Accrual Accounting

- Zero-dollar transactions for inventory valuation, bartering, and daily sales receipts

- Creating Vendor Credits involving inventory

- Managing Construction Retainage

- Journal Entries - when to use them, when NOT to use them, and what to do instead.

- Allocating Overhead Expenses across Classes

- Prepaid Expenses and Deferred Revenue - how to spread large transactions throughout the year instead of booking it all at once

- How to Void transactions in past periods

- Writing off accrual invoices

- How to set up Equity accounts for Sole Proprietors, Partnerships, and S-Corps.

- How to close Equity accounts at year’s end

After completing this course, you will be able to:

- Identify adjustments to a company’s books for taxes and compliance

- Differentiate between cash vs. accrual reporting needs

- Recognize how to use journal entries appropriately

- Recall how to create year-end equity allocations

Instructional LevelAdvanced Course Length3.5 hours Course Credits3.5 CPE, Certificate of Completion Field of StudyComputer Software & Applications Delivery MethodGroup Internet Based Who should take this class?

Prerequisites

Advance PreparationNone |

Accrual Accounting in QBO Course Description

Ready to go beyond the basics? For you, entering standard business transactions into QuickBooks Online is now routine. However, that’s just the beginning!

It’s time to learn indispensable and invaluable intermediate and advanced accounting techniques that bookkeepers use to increase the accuracy of a company's financial reports.

QBO Rock Star Alicia Katz Pollock has designed this course to be extremely accessible so that you can comfortably take a deeper dive into important accounting techniques.

She'll make sure you understand the difference between cash and accrual accounting, how to adjust inventory, when and when not to use Journal Entries, the ramifications of voiding transactions, how to manage Prepaid Expenses, and how to manage Equity for a variety of business formations.

Knowing how to confidently use these techniques will refine your clients’ financial reports and take them to the next level.

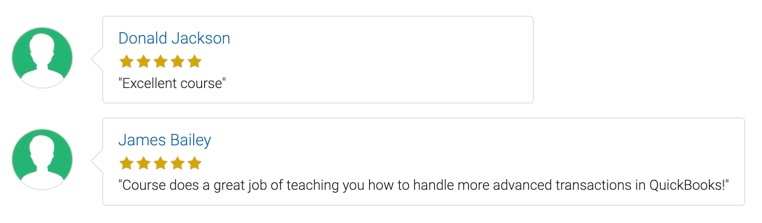

What people are saying about this 'Next-Level Accurate Accounting' course:

Discover the overwhelming praise as past learners share their experiences with this course. See all the reviews by clicking the 'Reviews' tab near the top of this page.

Watch it again later

You'll have lifetime access to the on-demand course including all handouts and class material. You'll also be able to ask questions in the Q&A forum and get answers, even years later. You can pause, rewind, speed up, and watch again and again as you apply what you learn to each situation as it crops up.

.png?lmsauth=c595f7221bcb54f2376055fbf7910e2c8efc8303)

Refunds & Cancellations

Please view our Terms of Service, for information on refunds, cancellations, and complaint resolution. To request a refund, please contact us.

Royalwise Solutions Inc. is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

Course Credits: 3.5 CPE, Certificate of Completion. Must be awarded within one year of enrollment.

Course Updated: June 2024

Course Page Updated: February 2026

Here is the course outline:

1. Download the Handouts: Required for CPE CreditDownload your class handouts here, required for CPE credit. 2 sections

|

||

|

2. Watch the Videos: Next-Level Bookkeeping in QBO 2024Learn indispensable advanced accounting techniques that bookkeepers rely on to increase the accuracy of a company's financial reports. 19 sections

|

|||||||||||||||||||

|

3. Quiz and CPE CreditTake this quiz to demonstrate your mastery of the material. Pass the quiz with an 80% or higher to complete the Course, earn your Certificate, and win points! 2 sections

|

||

|

Completion

The following certificates are awarded when the course is completed:

|

Royalwise CPE Certificate |